活動

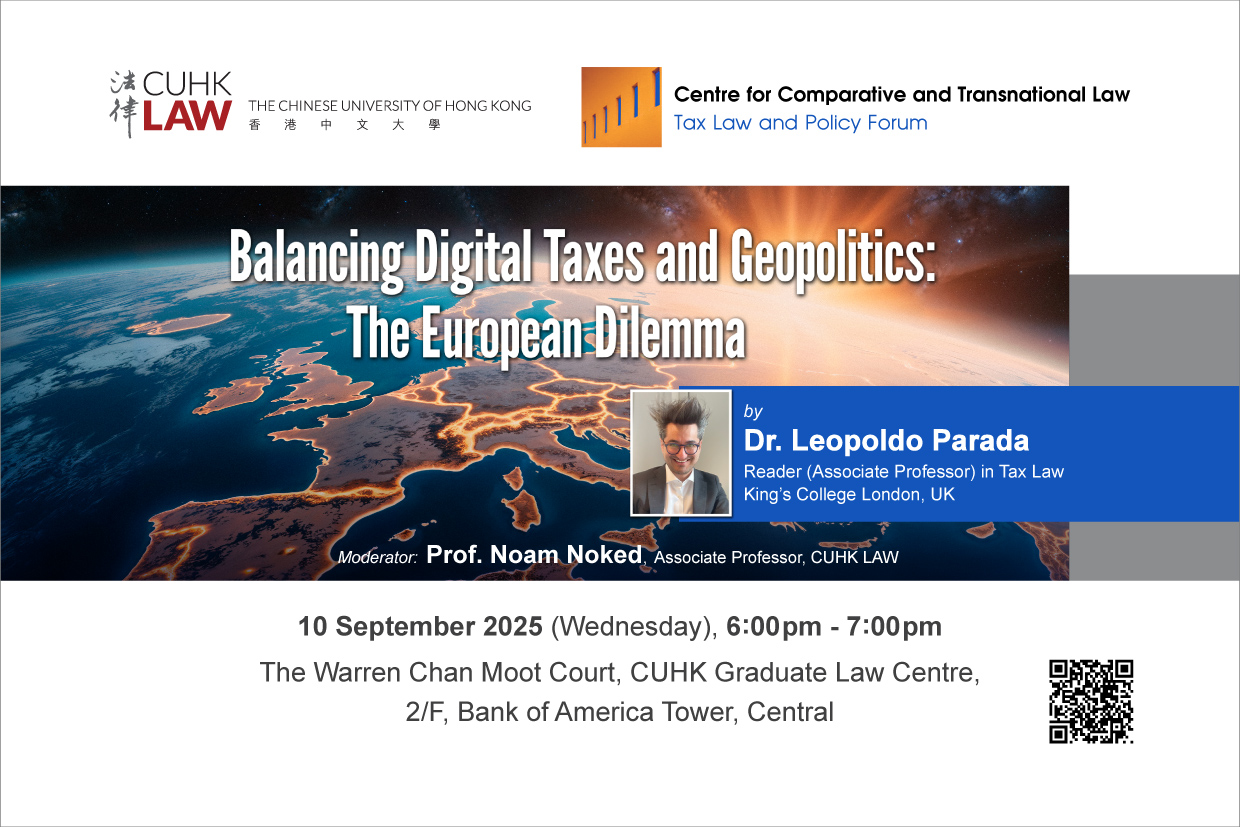

CUHK LAW CCTL Tax Law and Policy Forum Joint Seminar – ‘Balancing Digital Taxes and Geopolitics: The European Dilemma’ by Dr. Leopoldo Parada

2025年9月10日

6:00 pm – 7:00 pm (HKT)

The Warren Chan Moot Court, CUHK Graduate Law Centre, Central, Hong Kong

Dr. Leopoldo Parada, LLM, PhD, is a Reader (Associate Professor) in Tax Law at King’s College London in the UK. Previously he was an Associate Professor in Tax Law and Director or the Centre for Business Law and Practice (CBLP) at the University of Leeds School of Law. In the past he also held academic positions in Italy, Germany, and the Netherlands. Dr Parada also works as an independent tax policy advisor for different national governments and international organisations around the world, and have participated in different legislative tax reforms worldwide, including most recently the introduction of interest limitation rules in Indonesia and the OECD Pillar 2 in Curaçao and Suriname. His research focuses primarily on the international implications of BEPS, the application of tax treaties, and the European and international tax implications of the digitalisation of the economy. Dr Parada is the author of several books and academic articles, and he is also a regular speaker in specialised conferences around the world, including also specialised media outlets both within and outside the UK. Most notably, his academic work has been cited by US Congressional Research Service and by the EU Advocate General in his opinion on the CJEU case C-342/20 related to investment funds in Finland. He has also collaborated with the International Consortium of Investigative Journalists (ICIJ) in important investigations related to tax avoidance, including the recent “Pandora Papers” in 2021. In 2020, Dr Parada was recognised by the “TaxCOOP 35 Leaders of the Future in Taxation” (Canada) as one of the most promising tax policy experts worldwide.

https://cloud.itsc.cuhk.edu.hk/webform/view.php?id=13714991

Registration Deadline: 12:30 pm (HKT), 9 September 2025

This article argues that the complex current geopolitical scenario may prompt many to discard the idea of an EU-wide DST. However, this option is still viable, provided it is implemented with a balanced and carefully structured approach that combines at least four basic elements: a clear commitment to current or new international frameworks or a complete departure from them consolidating the idea of an EU DST as permanent, an EU-wide implementation of it, a solid structural design that avoids discriminatory pitfalls, and the use of strategic diplomacy. Yet, the European options are not limited to a DST. As argued also in this article, Europe possesses a much more efficient tool to deal with the taxation of digital services: the Value Added Tax (VAT). This latter option, although focused on consumers, with apparently reduced redistributive effects, and potentially increased compliance costs, still runs with advantages vis-à-vis other alternatives, especially a DST. Most notably, VAT is inherently non-discriminatory, it is highly harmonised across Europe, and it is trade neutral. These features make it a superior option in a world generally framed by the binary narrative of multilateral solutions versus DSTs.

This seminar is jointly co-organized by the CCTL Tax Law and Policy Forum and International Fiscal Association – HK Branch.

Language: English